Is Cash Truly a Better Safe Haven Than Gold?

Recently, CNBC published an article stating that investors have been dumping gold to jump into a preferred safe haven: cash. The saying goes that during times of market uncertainty and turmoil, cash is king. So, what would have happened if you held cash versus gold from May 2017 to May 2018?

We referred to a Historical Inflation Calculator that calculates the amount of CPI price inflation as reported by the US Bureau of Labor Statistics (BLS). Overall, there was a 2.8% depreciation in purchasing power due to inflation between May 2017 and 2018.

If you held $1 Million dollars in cash between May 2017 to 2018, at the ending period:

- Nominal value: $1 Million

- Real value: $971,781

- Dollar value if invested in gold: $1,021,800

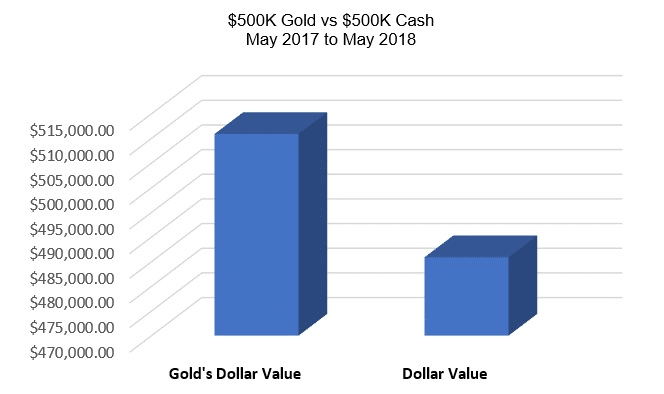

If you held $500,000 dollars in cash between May 2017 to 2018, at the ending period:

- Nominal value: $500,000

- Real value: $485,890

- Dollar value if invested in gold: $510,900

If you held $250,000 dollars in cash between May 2017 to 2018, at the ending period:

If you held $100,000 dollars in cash between May 2017 to 2018, at the ending period:

- Nominal value: $100,000

- Real value: $96,414

- Dollar value if invested in gold: $101,400

This is just a modest and short-term illustration of the inflation risks to which your cash is exposed.

When planning for your retirement, do not underestimate the effect that inflation may have on your assets. You want to achieve both growth and capital preservation. You want to maintain, or better yet, grow your purchasing power.

To achieve this, make sure your assets are properly allocated and diversified across a wide spectrum of assets so that your retirement savings can grow in terms of “real” and not just “nominal” value.

GSI Exchange can help you achieve this. Contact us to get a copy of our free retirement guide.

This article originally appeared on https://gsiexchange.com/

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.